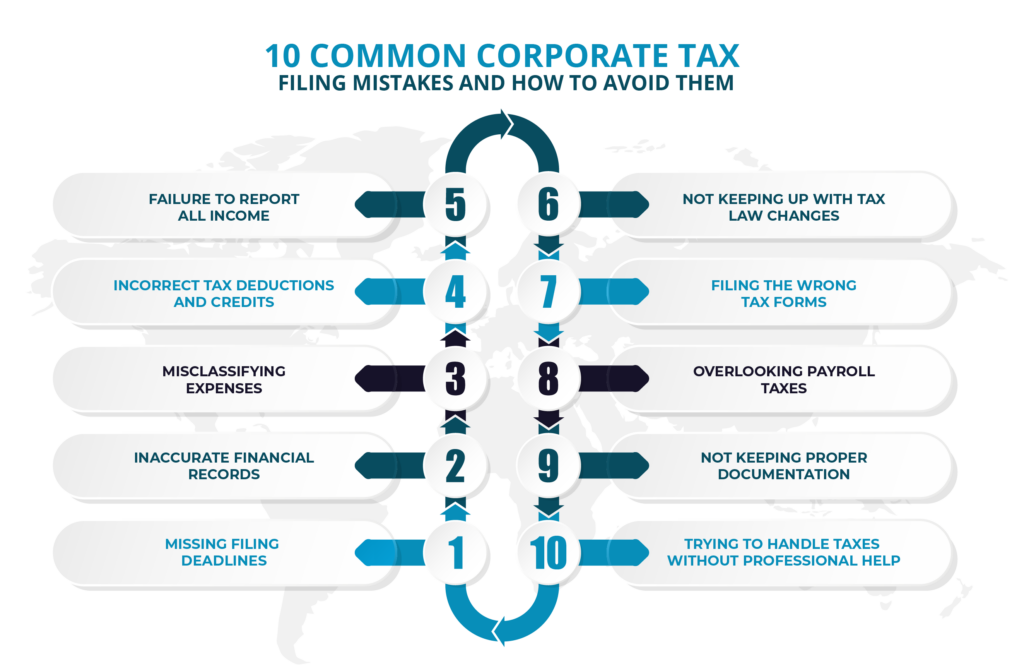

10 Common Corporate Tax Filing Mistakes and How to Avoid Them

Corporate tax filing is a responsibility of all businesses in the UAE!. However, many companies—big and small—make costly mistakes when filing corporate taxes.

These errors can lead to penalties, audits, and financial setbacks. Understanding these common pitfalls will help your business avoid them, saving it from unnecessary troubles.

In this blog post we are going to talk about the ten most common corporate tax filing mistakes. We will also tell you about the ways to avoid them.

Missing Filing Deadlines

How to Avoid It

- Mark tax filing deadlines on a calendar. You should also set reminders well in advance.

- Work with a tax professional for timely filing.

- Prepare tax documents early to avoid last-minute issues.

Inaccurate Financial Records

How to Avoid It

- Mark tax filing deadlines on a calendar. You should also set reminders well in advance.

- Work with a tax professional for timely filing.

- Prepare tax documents early to avoid last-minute issues.

Inaccurate Financial Records

How to Avoid It

- Maintain organized and updated financial records throughout the year.

- Use accounting software to track expenses.

- Conduct regular internal audits.

Misclassifying Expenses

How to Avoid It

- Clearly separate personal and business expenses.

- Consult a tax expert who can properly classify expenses.

- Keep detailed records of all business-related transactions.

Incorrect Tax Deductions and Credits

How to Avoid It

- Stay updated on the latest tax deductions available for businesses.

- Work with a tax professional for getting accurate deductions.

- Keep proper documentation to substantiate all claims.

Failure to Report All Income

How to Avoid It

- Keep thorough records of all revenue streams, including cash payments and digital transactions.

- Cross-check income statements against bank records and invoices.

- Checking third-party payments (e.g., through PayPal, Stripe, etc.) are properly accounted for.

Not Keeping Up with Tax Law Changes

How to Avoid It

- Regularly consult tax professionals or subscribe to tax news updates.

- Attend business tax events.

- Work with a financial advisor who specializes in corporate tax laws

Looking for corporate tax filing services?

Filing the Wrong Tax Forms

How to Avoid It

- Identify the correct tax form for your business type (e.g. corporations, for partnerships).

- Consult with a tax advisor for the correct form selection.

- Double-check all forms before submission to avoid errors.

Overlooking Payroll Taxes

How to Avoid It

- Use payroll software or work with a payroll service provider.

- Regularly review payroll tax requirements.

- Make timely deposits of payroll taxes to avoid penalties.

Not Keeping Proper Documentation

How to Avoid It

- Keep copies of all tax returns, receipts, invoices, and supporting documents for at least seven years.

- Use cloud storage-keeping systems for easy access.

- Check if all records are well- categorized properly.

Trying to Handle Taxes Without Professional Help

How to Avoid It

- Hire a qualified tax professional.

- Use trusted accounting software if managing taxes independently.

- Conduct an annual tax review with a specialist to identify potential issues.

FAQs

Underreporting can lead to penalties, audits, and legal consequences.

Incorrect expense claims can lead to rejected deductions and possible fines.

Use reliable accounting software or consult a tax professional.

Claiming ineligible expenses, missing allowable deductions, or misclassifying costs.

Mistakes in VAT reporting can trigger audits and financial penalties.

Financial statements, invoices, expense records, and tax returns.

Regular audits, professional advice, and up-to-date tax knowledge.

Experts help minimize errors, maximize deductions, and ensure full compliance.

Conclusion

That’s a wrap for ‘10 Common Corporate Tax Filing Mistakes and How to Avoid Them’

Corporate tax filing mistakes can lead to serious legal consequences.

By staying proactive, keeping accurate records, and working with tax professionals, businesses can minimize errors.

Lastly, avoiding these common pitfalls will not only save time and money but also provide peace of mind in managing corporate tax obligations.