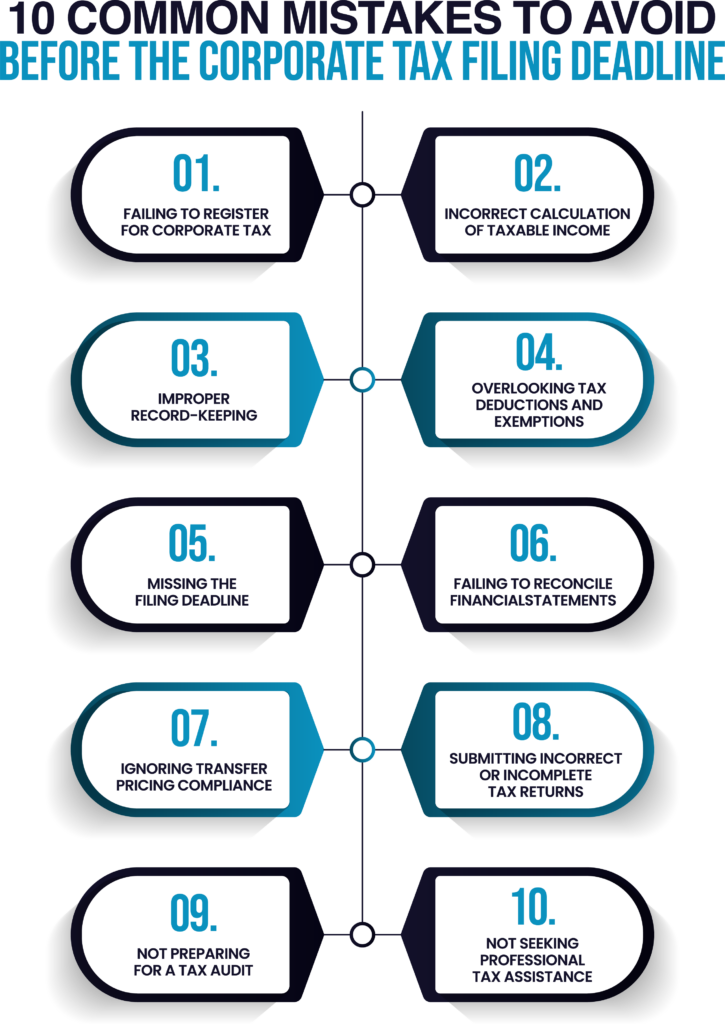

10 Common Mistakes to Avoid Before the Corporate Tax Filing Deadline

Corporate tax filing is a responsibility for all businesses operating in the UAE. As the country enforces its corporate tax regulations, companies must meet compliance requirements to avoid any financial setbacks.

Missing deadlines, incorrect filings, or overlooking details can lead to legal consequences.

To help you prepare for the tax filing process we are going to break down the ten common mistakes businesses should avoid before the corporate tax filing deadline.

Failing to Register for Corporate Tax

Every business that meets the corporate tax threshold must register with the FTA. Some companies mistakenly assume they are exempt and fail to register. This leads to non-compliance penalties.

So, you should always check the registration requirements and complete the process within the stipulated timeline.

Incorrect Calculation of Taxable Income

Misreporting taxable income is a common error that can lead to audits. That’s why businesses must include all relevant revenue sources along with deduct allowable expenses .

Furthermore, you should maintain all of your financial records. Other than that you can also seek professional accounting assistance to prevent miscalculations.

Improper Record-Keeping

You should maintain accurate financial records for corporate tax compliance. A lot of businesses in the UAE fail to keep track of their invoices, expense receipts, and financial statements, leading to difficulties during tax filing.

The UAE tax regulations require companies to maintain financial records for a specific period, so always have proper documentation in place.

Overlooking Tax Deductions and Exemptions

Many businesses either fail to claim eligible tax deductions or incorrectly apply exemptions. The UAE corporate tax system allows for certain deductions, such as business expenses, depreciation, and specific allowances.

Furthermore, understanding which deductions apply to your business can reduce the taxable income.

As a leading professional and consultancy firm in the UAE, MHR Chartered Accountants offers a wide range of exceptional corporate services to our clients.

MHR services includes Audit & Assurance, Financial Accounting, Financial & Business Advisory, Taxation including VAT, Corporate Tax & Excise Tax, Company Setup, regulatory & compliance and Management Consultancy.

Missing the Filing Deadline

One of the most common mistakes businesses make is missing the corporate tax filing deadline. The UAE Federal Tax Authority (FTA) has strict deadlines for corporate tax submissions. Failing to file on time can lead to hefty fines.

That’s why we recommend businesses to maintain a tax calendar well in advance to get timely submission.

Failing to Reconcile Financial Statements

Inconsistencies between financial statements and tax returns can raise red flags with the authorities.

That’s why as a business in the UAE your accounting records should align with their respective corporate tax filings. You can conduct periodic reconciliations to help identify discrepancies before submission.

Ignoring Transfer Pricing Compliance

Businesses that engage in transactions with related entities must follow transfer pricing regulations. Failure to justify intercompany transactions can lead to tax adjustments.

Lastly, companies should also maintain proper transfer pricing documentation to support their pricing structures.

Submitting Incorrect or Incomplete Tax Returns

Errors in tax return submissions, such as missing details, incorrect figures, or unreported income, can result in fines.

Our experts always recommend double-checking all tax return forms before submission. You can also utilize tax software or consult with tax professionals to find any mistakes.

Not Preparing for a Tax Audit

Businesses in the UAE should be ready for possible tax audits any time of the year. They should maintain proper records which align with the UAE’s tax laws.

Additionally, some companies fail to prepare for audits. This leads to stressful situations for them. To get around this you can run regular internal audits.

Not Seeking Professional Tax Assistance

Many businesses try to handle corporate tax filings without professional guidance. This costs businesses thousands of dirhams in the long run.

We suggest working with a tax consultant who understands the UAE tax laws for accurate tax planning. These professional tax advisors help businesses take advantage of legal tax-saving methods.

FAQs

Missing the tax filing deadline can result in penalties, interest charges, and increased scrutiny from the Federal Tax Authority (FTA). It’s essential to submit your corporate tax return within nine months from the end of your financial year to remain compliant.

Registration on this portal is mandatory for Designated Non-Financial Businesses and Professions (DNFBPs) to report suspicious activities, as stipulated by Federal Decree Law No (20) of 2018 and Article 20(2) of Cabinet Decision No (10) of 2019.

Inaccurate or incomplete financial statements can lead to non-compliance, potential fines, and audits. Ensure that all financial data is accurate and up-to-date to reflect your company’s true financial position.

Inaccurate or incomplete financial statements can lead to non-compliance, potential fines, and audits. Ensure that all financial data is accurate and up-to-date to reflect your company’s true financial position.

Inaccurate or incomplete financial statements can lead to non-compliance, potential fines, and audits. Ensure that all financial data is accurate and up-to-date to reflect your company’s true financial position.

Inaccurate or incomplete financial statements can lead to non-compliance, potential fines, and audits. Ensure that all financial data is accurate and up-to-date to reflect your company’s true financial position.

Inaccurate or incomplete financial statements can lead to non-compliance, potential fines, and audits. Ensure that all financial data is accurate and up-to-date to reflect your company’s true financial position.

Inaccurate or incomplete financial statements can lead to non-compliance, potential fines, and audits. Ensure that all financial data is accurate and up-to-date to reflect your company’s true financial position.