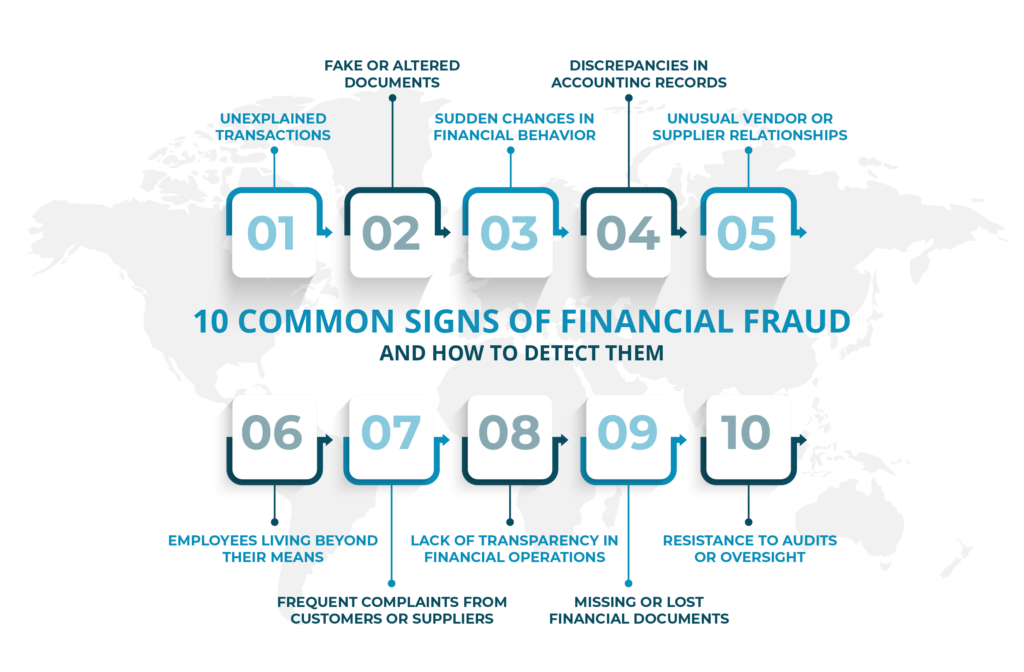

10 Common Signs of Financial Fraud and How to Detect Them

Financial fraud is a serious concern for businesses and individuals alike. Fraudsters use various deceptive techniques to manipulate financial transactions. This results in severe financial losses.

Detecting financial fraud early can save organizations and individuals from huge monetary harm. That’s why in this blog post we are going to talk about the ten common signs of financial fraud. We will also discuss how you can detect these frauds.

Unexplained Transactions

- Regularly review bank statements or financial reports.

- Cross-check transactions with invoices.

- Use financial software to flag unusual transactions.

Fraudsters often make unauthorized transactions. They do this hoping they go unnoticed. If you see transactions that don’t match with your records, investigate them immediately.

Fake or Altered Documents

- Verify the authenticity of invoices, contracts, and financial statements.

- Look for inconsistencies, such as mismatched fonts or missing details.

- Conduct periodic audits to ensure document accuracy.

Fraudulent documentation is a common tactic used to cover up financial fraud. Always confirm the legitimacy of financial records before processing payments or making decisions.

Sudden Changes in Financial Behavior

- Monitor employee and vendor transactions for unusual patterns.

- Pay attention to sudden increases in expenses or withdrawals.

- Compare financial performance to previous records.

If an individual or organization suddenly starts spending or withdrawing large sums without justification, it could indicate fraudulent activity.

Discrepancies in Accounting Records

- Perform routine reconciliations of financial accounts.

- Watch for missing entries or altered figures in financial statements.

- Implement checks and balances in accounting practices.

Errors in financial records can indicate manipulation or fraud. Reviewing financial data regularly ensures accuracy and transparency.

Unusual Vendor or Supplier Relationships

- Scrutinize new vendors and their legitimacy.

- Check for overpayments or duplicate invoices.

- Verify vendor addresses and business registrations.

Fraudsters sometimes create fake suppliers to issue fraudulent invoices. Ensuring due diligence when dealing with vendors can prevent such scams.

Looking for financial fraud detection services?

MHR services includes Audit & Assurance, Financial Accounting, Financial & Business Advisory, Taxation including VAT, Corporate Tax & Excise Tax, Company Setup, regulatory & compliance and Management Consultancy. (CTA)

Employees Living Beyond Their Means

- Observe lifestyle changes that seem inconsistent with salary levels.

- Pay attention to employees suddenly purchasing luxury items or taking extravagant trips.

- Cross-check financial statements with employee expense reports.

While personal finance is private, significant lifestyle changes in employees could indicate misappropriation of funds or internal fraud.

Frequent Complaints from Customers or Suppliers

- Keep a record of complaints about billing issues or missing payments.

- Investigate repeated disputes regarding financial transactions.

- Maintain open communication with customers and suppliers to detect discrepancies early.

Regular complaints about financial transactions can signal fraudulent activities, requiring immediate attention and resolution.

Lack of Transparency in Financial Operations

- Ensure financial statements and reports are available for review.

- Encourage open discussions about company finances.

- Establish a whistleblower policy for reporting suspicious activities.

A lack of transparency often indicates fraudulent activities within an organization. Promoting accountability and transparency reduces the risk of financial fraud.

Missing or Lost Financial Documents

- Keep a secure and organized record of all financial documents.

- Implement digital backups to prevent loss of information.

- Investigate missing documents immediately.

Fraudsters often manipulate records by making financial documents disappear. Implementing strict document control measures can help prevent fraud.

Resistance to Audits or Oversight

- Watch for employees or departments that avoid audits.

- Conduct surprise audits to detect potential fraud.

- Establish strong internal controls and independent review mechanisms.

If individuals or teams resist financial audits or scrutiny, they may have something to hide. Regular audits and financial reviews can help uncover fraud before it escalates.

FAQs

It involves deceptive financial practices for personal or business gain.

Unexplained transactions, missing records, and irregular financial statements.

Regular audits, transaction monitoring, and employee whistleblower programs.

They reduce risks by enforcing checks, balances, and accountability.

Yes, small businesses are often more vulnerable due to fewer controls.

Overcharging, fake invoices, or duplicate payments to siphon funds.

Investigate records, consult forensic auditors, and report the issue.

It identifies unusual patterns, transactions, and anomalies in financial data.

Often, fraud can also come from vendors, customers, or executives.

Strong oversight, regular audits, fraud training, and strict financial controls.

Conclusion

That’s a wrap for ‘10 Common Signs of Financial Fraud and How to Detect Them’

Detecting financial fraud requires vigilance, transparency, and a proactive approach. By monitoring financial records, implementing strict controls, and conducting regular audits, businesses and individuals can protect themselves from fraudulent activities.

If you suspect financial fraud, take immediate action to investigate and mitigate potential losses. Awareness and early detection are key to preventing financial fraud from causing significant damage.