Excise Tax Services

GET STARTED

Excise And Taxation Services

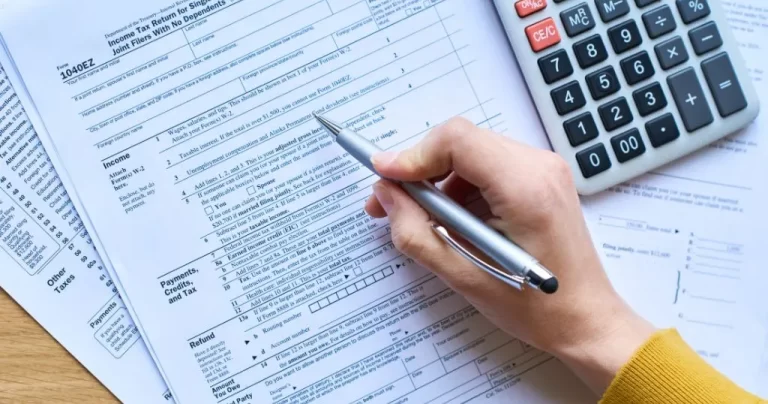

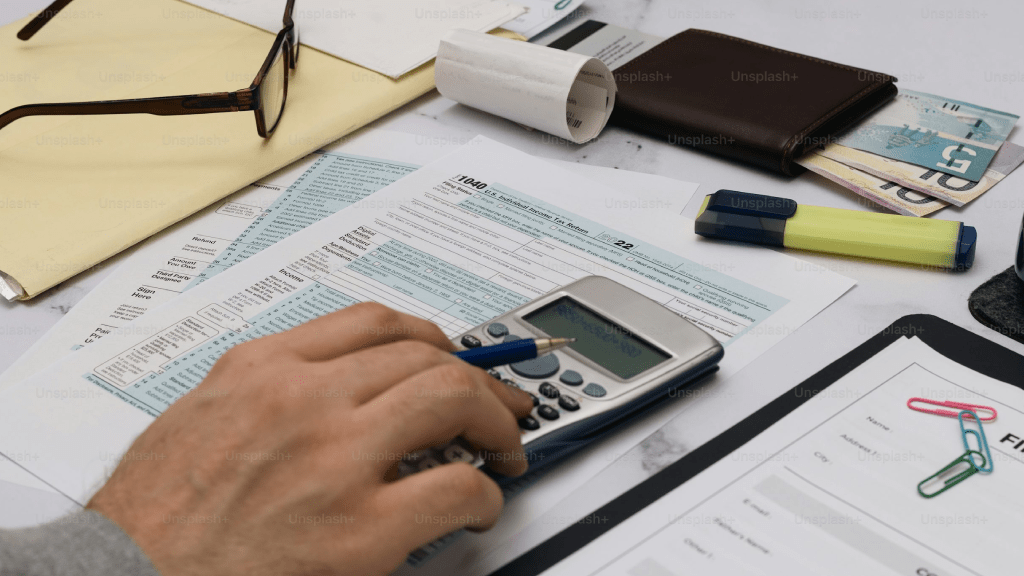

Comprehensive Excise Tax Services UAE

The UAE’s excise tax laws are always changing, and many firms find it difficult to manage compliance, particularly those who manufacture, import, or sell excise items. MHR excise taxation services are intended to provide companies with support through every step of the excise tax procedure.

With MHR you get adherence to the rules set out by the Federal Tax Authority (FTA) of the United Arab Emirates . We collaborate closely with customers to make sure they fulfil all the requirements. We put into practice smart tax plans that improve their business operations.

Featured Services

Explore UAE Excise and Taxation Services

Excise Tax Regisration

Excise Tax Advisory & Planning

Excise Tax Compliances

Excise Tax Reporting

Excise Tax Audit Support

Excise Tax Services

Why File Excise Tax In UAE?

In order to keep your company in compliance with UAE excise tax laws, our team offers end-to-end excise taxation services. We provide services that lead to minimum risks. We also cut expenses, and maximize your tax plan. At MHR we do everything from registration to reporting. We manage all facets of excise tax administration. These include filing, audit assistance, and ongoing compliance, so your company can concentrate on expansion while still adhering to all tax regulations.

Stay Ahead with Expert Excise Tax Guidance

Have Questions About Our Services?

We’re Here to Help

Excise Tax Services In Dubai, UAE

FAQS

Frequently Asked Questions

Excise tax is a tax levied on specific goods, such as tobacco, alcohol, and energy drinks. Businesses that import, produce, or sell these goods in the UAE are required to register for excise tax and ensure compliance with local regulations.

To register for excise tax, businesses must submit an application through the Federal Tax Authority (FTA) portal, providing the necessary documents and details about their business activities. We offer support throughout the entire registration process to ensure smooth compliance.

Failure to comply with excise tax regulations can lead to significant penalties, including fines, back taxes, and potential suspension of business operations. It’s crucial to stay compliant with filing and payment deadlines to avoid these penalties.

Excise tax returns must be filed on a monthly basis, with payments due within the first 15 days of the following month. Timely filing ensures compliance and avoids late fees and penalties.

Yes, we provide full support during excise tax audits and disputes. Our team assists in preparing documentation, responding to queries from the Federal Tax Authority, and ensuring that your business is fully compliant throughout the audit process.