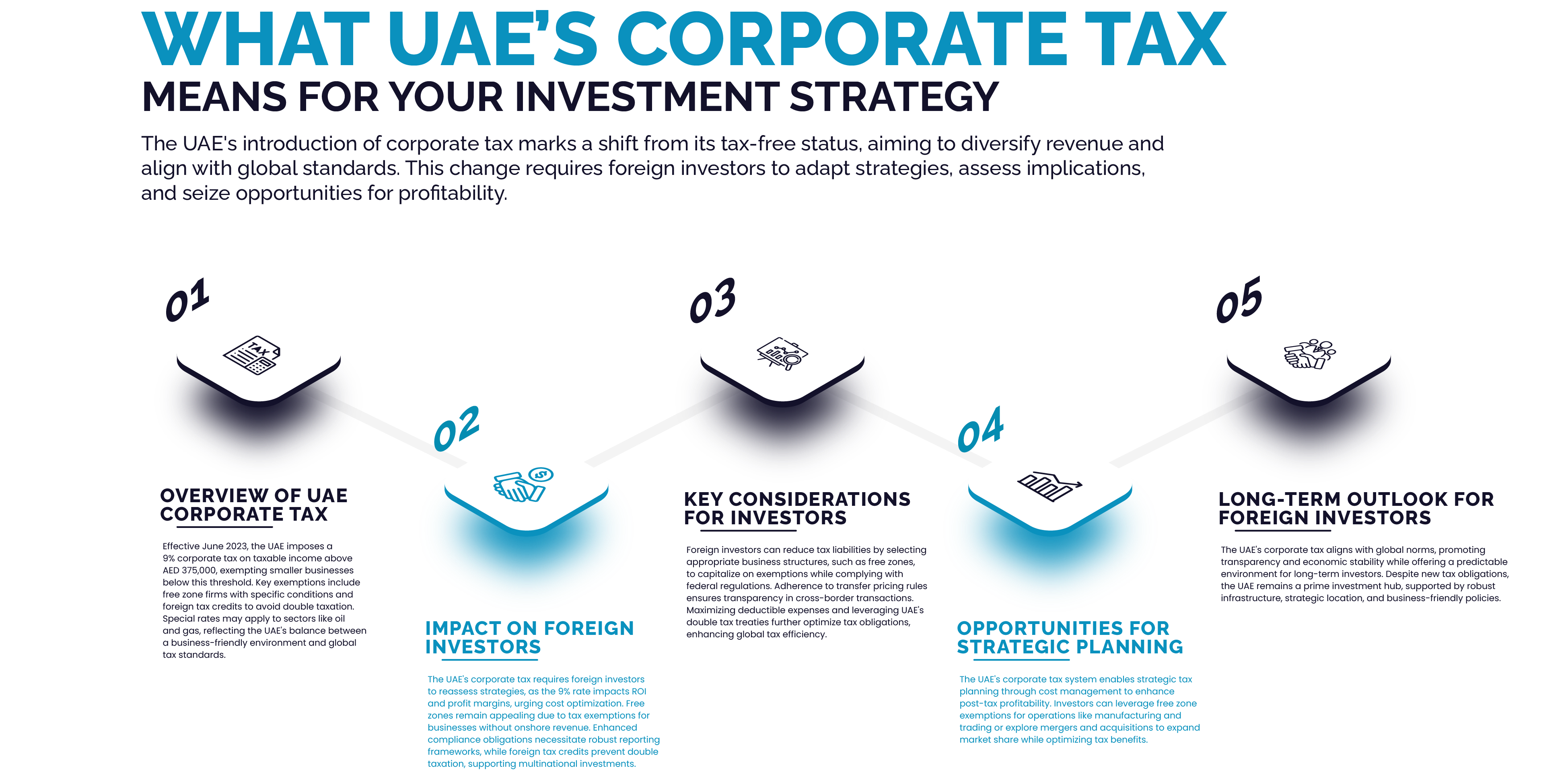

What UAE’s Corporate Tax Means for Your Investment Strategy

Overview of UAE Corporate Tax

Corporate tax, effective from June 2023, is applicable to both UAE-based businesses and foreign entities conducting substantial business within the Emirates. The standard rate is set at 9% for taxable income above AED 375,000, with income below this threshold exempted to support small and medium-sized businesses. Companies involved in sectors such as oil and gas, as well as government-owned enterprises, may have different tax rates.

Key Exemptions and Allowances:

- Small businesses: Companies earning below AED 375,000 are exempt from corporate tax.

- Free zone businesses: Firms operating within designated free zones may continue to enjoy certain tax benefits, provided they do not conduct business onshore.

- Foreign tax credits: Businesses can claim credit for taxes paid abroad to avoid double taxation.

These measures highlight the UAE’s intent to foster a business-friendly environment while contributing to global economic standards.

Impact on Foreign Investors

1. Strategic Reassessment of Investments

2. Changes in Profit Margins

3. Free Zone Benefits

4. Increased Compliance and Reporting Obligations

With corporate tax, businesses are subject to enhanced compliance requirements, including financial reporting and documentation. Foreign investors must ensure accurate and timely reporting to avoid penalties, requiring a robust accounting and compliance framework.

5. Foreign Tax Credits

Key Considerations for Investors

1. Business Structure and Jurisdiction

2. Transfer Pricing Compliance

3. Deductible Expenses

4.Utilizing Tax Residency Benefits

Opportunities for Strategic Planning

The corporate tax system in the UAE creates a structured environment for tax planning, offering opportunities to optimize investment strategies. Key approaches include:

- Effective Cost Management: By analyzing cost structures, businesses can identify areas for efficiency, enhancing profitability after tax.

- Investment in Free Zones: Given the exemptions available in free zones, investors might consider structuring their operations to take advantage of these zones, especially for manufacturing and trading activities.

- Exploring Mergers and Acquisitions (M&A): Tax considerations may encourage companies to explore M&A opportunities within the UAE to expand their market share while leveraging potential tax benefits.

Long-term Outlook for Foreign Investors

The introduction of corporate tax reflects the UAE’s commitment to aligning with international tax norms, fostering transparency, and ensuring long-term economic stability. While the tax may seem like an additional cost, the structured tax environment offers predictability, which is valuable for long-term investors.

The UAE government continues to position the country as a leading investment hub, supported by robust infrastructure, strategic geographic location, and favorable business policies. Despite the new tax obligations, the UAE remains an attractive destination for foreign investments, offering a balanced regulatory framework and supportive economic policies.